This comprehensive Deriv review examines one of 2025’s most accessible brokers for new traders. Born from Binary.com (est. 1999), Deriv combines ultra-low entry barriers with unique synthetic indices. We’ll analyze its safety, platforms, and suitability for beginners—helping you decide if it aligns with your trading goals.

View Table of Contents

Table of Contents

Why Traders Choose Deriv in 2025

- $5 Minimum Deposit: Start live trading with minimal risk.

- Zero Commissions: Costs embedded in spreads for core CFDs.

- 24/7 Synthetic Indices: Algorithm-based markets (Volatility/Step/Jump indices) for round-the-clock trading.

- Beginner-Oriented Platforms: Intuitive web-based DTrader, DBot, and SmartTrader requiring no downloads.

- Free $10k Demo: Practice strategies risk-free.

Markets & Instruments

- Forex: 50+ pairs (EUR/USD, USD/ZAR)

- Synthetics: Proprietary 24/7 indices

- Stocks & ETFs: MetaTrader-only access

- Commodities: Gold, oil, silver

- Cryptocurrencies: BTC, ETH, LTC CFDs

- Multipliers: High-risk leveraged products

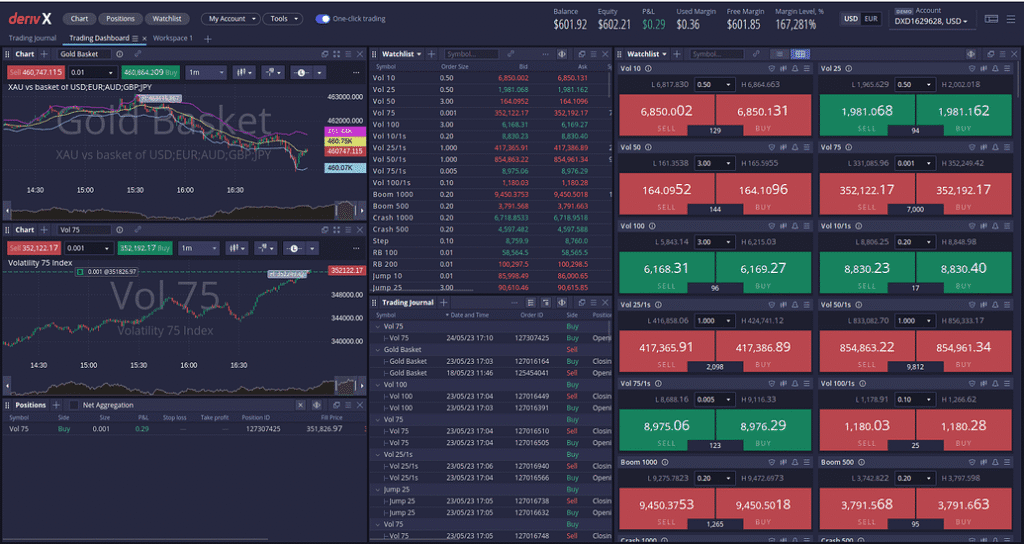

Trading Platforms Deriv Reviewed

| Platform | Best For | Key Features |

|---|---|---|

| DTrader | Beginners & CFD traders | TradingView charts, 1-click orders |

| DBot | Automated strategies | No-code visual bot builder |

| SmartTrader | Fast options trading | Simplified interface, multipliers |

| Deriv GO | Mobile trading | Multiplier/options focus |

| MetaTrader 5 | Advanced charting | EAs, scripting (limited assets) |

Is Deriv Safe? Regulation Analysis

Deriv operates under multiple entities, but not top-tier regulators:

- Labuan FSA (Malaysia): Deriv FX Ltd (License MB/18/0024)

- VFSC (Vanuatu): Deriv V Ltd (License 700238)

- FSC Mauritius: Deriv MX Ltd (License GB21026295)

- FSA SVG (Registration only): No active oversight

Safety Notes:

✅ Segregated client funds

⚠️ No investor compensation schemes (unlike FCA/ASIC brokers)

✅ Transparent fee structure

⚠️ Limited dispute resolution avenues

Strengths & Considerations

Pros:

- $5 minimum deposit

- Unique 24/7 synthetic indices

- Beginner-friendly platforms

- Extensive demo account

- Global accessibility

Limitations:

- Offshore regulation lowers protection

- Phone support unavailable in most regions

- Withdrawals take 1-3 business days

- MT5 offers fewer assets than competitors

Final Verdict: Who Is Deriv For?

Choose Deriv if you:

- Are a beginner testing strategies with $5+ capital

- Prioritize synthetic indices or algorithmic trading

- Value simple web platforms over advanced tools

- Understand offshore regulation risks

Avoid if you:

- Require FCA/ASIC-tier investor protection

- Prefer long-term stock investing

- Need phone support or instant withdrawals

Soft CTA: Explore Deriv’s platforms and synthetic indices with their $10k demo account to test its fit for your 2025 strategy.

FAQs – Deriv Review 2025

Q: Is Deriv a safe broker for beginners?

A: Deriv is a legitimate broker but operates under offshore regulators (Labuan FSA, VFSC). While it segregates client funds, beginners should start small due to limited investor protection. Use its demo account first.

Q: What’s the minimum deposit for this Deriv review?

A: Deriv requires just $5 to start live trading, making it one of 2025’s most accessible brokers. Ideal for testing strategies with minimal capital.

Q: Can I trade Forex on Deriv?

A: Yes, Deriv offers 50+ Forex pairs via DTrader and MT5. Spreads start from 0.5 pips on majors like EUR/USD with no commissions.

Q: Does Deriv support copy trading?

A: While Deriv lacks social copy tools, its DBot platform lets users build automated strategies visually—no coding needed.

Q: How long do Deriv withdrawals take?

A: Withdrawals process in 1-3 business days. E-wallets (Skrill, Neteller) are fastest; bank wires take longer.

Q: Is Deriv available in South Africa/India?

A: Yes! South African traders fall under FSCA oversight, while Indian clients access services via the SVG entity. Always check local regulations.

Risk Warning: CFD and multiplier trading pose significant risks. 77% of retail investor accounts lose money. Deriv’s synthetic indices are highly volatile. Only trade with capital you can afford to lose. Past performance ≠ future results.