A forex trading plan is your battle-tested blueprint for navigating the $6.6 trillion currency market. Without one, 90% of traders blow accounts within 6 months (CFTC 2024). This step-by-step 2025 guide transforms vague hopes into structured rules—covering strategy selection, risk limits, and psychological discipline for consistent profits.

What Is a Forex Trading Plan?

A forex trading plan is a written document specifying:

- WHAT you trade (currency pairs, sessions)

- HOW you trade (entry/exit rules)

- WHEN you trade (schedule, triggers)

- WHY each rule exists (risk logic)

It’s non-negotiable: Professionals treat plans like flight checklists—amateurs wing it.

5 Proven Benefits of a Trading Plan

- Kills Emotional Trading:

- Rules prevent revenge trades after losses

- Builds Consistency:

- 78% of profitable traders follow plans religiously (MyFxBook Study)

- Measures Progress:

- Track ROI against predefined targets

- Simplifies Scaling:

- Clear rules for increasing capital allocation

- Provides Accountability:

- Journal exposes rule violations

Key Components of a Winning Forex Trading Plan

1. Trading Goals (Realistic & Quantifiable)

- Bad: “Make money”

- Good: “3% monthly ROI, max 5% monthly drawdown”

2. Market Session & Currency Pairs

- Example:“Trade London session (07:00-10:00 UTC) only; focus on EUR/USD and GBP/USD”

3. Strategy Rules (Entry/Exit Setup)

- Entry:“Buy when EMA 50 > EMA 200 + RSI >30 at daily support”

- Exit:“Sell at 1:3 risk-reward or when EMA 50 flattens”

4. Risk Management Protocol

| Rule Type | Example |

|---|---|

| % Risk per Trade | Max 1% of account |

| Stop-Loss | 1.5x ATR from entry |

| Lot Size | Micro lots only ($0.10/pip) |

5. Psychological Safeguards

- “Max 3 trades/day”

- “Stop trading after 2 consecutive losses”

- “Mandatory 24hr break if monthly drawdown >5%”

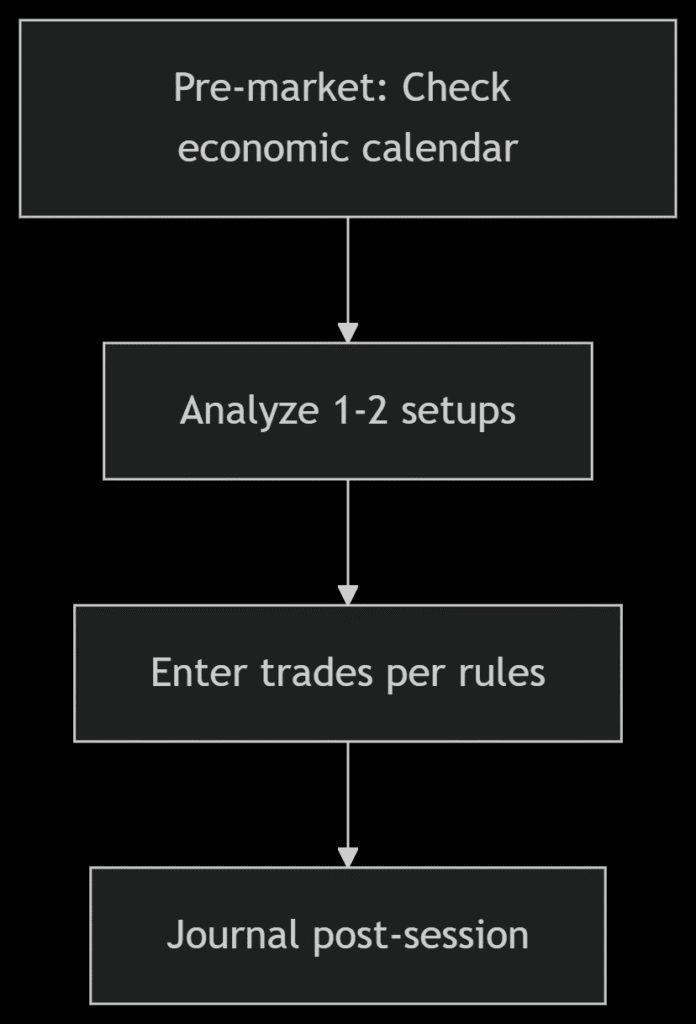

6. Daily Routine

Build Your Plan in 7 Steps (Template Included)

- Choose Your Strategy (Test 3 months historical data):

- Scalping: 5-10 pip targets

- Swing: 50-200 pip targets

- Set Risk Tolerance:

- Conservative: ≤1% per trade

- Aggressive: ≤3% (only for >$10K accounts)

- Define Trading Schedule:

- Match sessions to strategy (e.g., London overlap for EUR/USD scalping)

- Backtest Rigorously:

- Use TradingView replay mode

- 100+ trades for statistical significance

- Forward Test on Demo:

- 1 month minimum with real-market conditions

- Create Rules Checklist:

- Launch & Monitor:

- Start with 50% position sizes for first 20 trades

Testing & Optimizing Your Plan: The Trader’s Feedback Loop

Trade Journal Essentials:

| Field | Purpose |

|---|---|

| Entry/Exit Reason | Verify rule compliance |

| Emotional State | Identify tilt triggers |

| Screenshot | Visual review of setups |

🔄 Improvement Cycle: Review journal weekly → Tweak 1 variable monthly → Never overhaul mid-drawdown.

5 Deadly Mistakes to Avoid

- Vagueness Kill Plans:

- ❌ “Trade reversals sometimes”

- ✅ “Trade RSI <30 bounces at daily support only”

- Ignoring Risk Caps:

- 5% drawdown = 26% harder recovery (MyFxBook)

- Copy-Pasting Plans:

- Your sleep schedule ≠ New York session scalper’s

- Overcomplicating:

- Max 3 indicators + 2 currency pairs

- Skipping Backtesting:

- 92% of untested strategies fail live (Journal of Trading 2024)

Conclusion: Your Blueprint for Consistency

A robust forex trading plan forces discipline—turning emotional reactions into systematic execution. Remember:

- Beginners: Start with micro lots + 1 strategy

- Intermediate: Add pairs only after 6 profitable months

- Experts: Refine risk rules quarterly

❓FAQs – Forex Trading Plan

Q: What is a forex trading plan?

A: A written set of rules covering what you trade, how you enter/exit, risk limits, and psychological safeguards.

Q: How detailed should my trading plan be?

A: Extremely specific—e.g., “Risk 1% per trade, exit at 1:3 RR or when EMA 20 crosses against position.”

Q: Do I need a trading plan if I only scalp?

A: Absolutely! Scalping requires tighter rules (e.g., max 2% daily loss cap, 5-pip stop losses).

Q: Can I use someone else’s trading plan?

A: As inspiration only—adapt every rule to your risk tolerance, schedule, and psychological triggers.

Q: How often should I update my trading plan?

A: Review monthly, adjust quarterly. Never change rules during drawdowns.

![What Is Forex Trading and How Does It Work? [2025 Best Beginner’s Guide] What is Forex trading diagram](https://forexbrokeredge.com/wp-content/uploads/2025/07/steptodown.com387397-1024x683.jpg)

![Forex Market Sessions: Best Time to Trade for Each Currency Pair [New 2025 Guide] Forex Market Sessions: Best Time to Trade for Each Currency Pair [New 2025 Guide]](https://forexbrokeredge.com/wp-content/uploads/2025/07/sessions-stock-1024x554.jpg)